We also offer additional benefits that go beyond filing your taxes, but they are optional and are not required to file simple taxes for free. Credits, deductions and income reported on schedules 1-3Ĭustomers with more complex tax situations will file with our paid TurboTax products that provide all the additional forms and guidance they need.Unemployment income reported on a 1099-G.Situations not covered in TurboTax Free Edition include: Limited interest and dividend income reported on a 1099-INT or 1099-DIV.Situations covered in TurboTax Free Edition include: You can file with TurboTax Free Edition if you have a simple tax return.* When you chose to “start” in the Free Edition -ĭirectly below the words “Free Edition” there is a blue link that says “For simple tax returns only” If you click that link it brings up this information: If you started in the Free Edition and entered any data that required any of those three schedules, you have to upgrade to a paid version and if you are watching the screens carefully you are alerted to the upgrade. Using the standard deduction instead of itemizing does NOT mean you will not need any of those schedules.

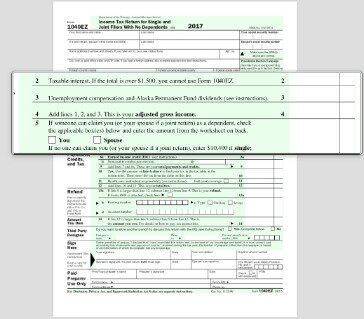

Everything goes on a Form 1040 that has three extra "schedules" with it, and if you need any of those schedules, you are not able to use the Free Edition. Thanks to the new tax laws that began for 2018 returns, there are no more simple Form 1040EZ or 1040A's. The information that you can enter in Free Edition is pretty limited now. WHY DO I HAVE TO PAY? I WANT THE FREE EDITION

0 kommentar(er)

0 kommentar(er)